Have you ever stayed up all night in the library putting the finishing touches on a group project, only to have your partner who was sleeping shine in the presentation and get all the praise?

There are few feelings more frustrating than others reaping the rewards for your hard work. When I left my first job as an insurance broker at Northwestern Mutual, I couldn’t help but relate to this classic scenario.

I’d began there as an intern and went full time when I graduated. I worked diligently and managed to pick up 10-12 decent clients. But the second I decided to go out on my own, Northwestern held the rights to all of the renewal income that I would have been receiving from those clients for years to come, and financially speaking I was left with nothing.

I did receive valuable training and experience. And that can often be worth its weight in gold.

If you’re pursuing entry level insurance jobs, I wouldn’t necessarily advise against this path, but there are some important things you need to understand if you want to make decisions in your best interest.

The following are 5 things you must know when considering pathways in insurance careers.

1. Compensation Types

Cost of living in 2018 is high and one of the first questions you will undoubtedly seek to answer is how much do insurance brokers make?

More important than answering this question is understanding the different types of compensation for insurance jobs, and (crucially) the common ways they’re structured.

Similar to the financial advisory industry, the 3 basic types of compensation for insurance jobs include:

- Commissions: You make a percentage of the gross revenue from clients you bring in.

- Salary: You’re paid a set yearly amount that is negotiated and agreed upon up front.

- Renewal Commissions: For clients you bring in that remain with your firm, you continue to make a percentage of the gross revenue brought in each year after the initial sale.

These compensation types can be offered as stand-alone or in combination. Let me explain.

2. Compensation Structures

You may be offered commission-only compensation, a higher salary with lower commission, or a higher commission with a lower salary.

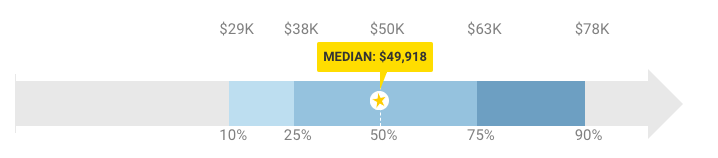

Commissions commonly range from 20-40% of gross revenue, so if you’re bringing in a client making $1,000 for your company, you might take $200-400 in commissions. An entry level insurance broker salary (source) can range from $30,000-100,000, and typically decreases over time, while commissions increase as you bring in new clients.

Key idea: An often neglected piece of the puzzle is renewal commissions. Larger companies may entice you with a solid commission rate for the first year, but one that decreases in the years to follow.

I want to urge you to think hard about the future income you’re potentially giving up when companies structure renewal commissions in this way, and how long you’re willing to give it up for.

In addition to considering these compensation structures, there are other pros and cons that should also be taken into account.

3. The Tradeoffs Are Real

Aside from purely monetary compensation, companies can also offer other things like training. It’s a good lesson to learn early on in your career that training and experience are valuable.

We hear it all the time. Someone takes a job with less than ideal pay with the logic that it will pay off in the long run.

Key idea: It’s useful to think of what companies can offer you as a spectrum. On one side you have bigger companies that offer more resources, such as training and marketing, with less ideal compensation structures. On the other end with smaller firms or going completely independent, you have less training and resources with more ideal compensation.

As an independent broker, for example, you have complete ownership of your business. When you make $1,000 in gross revenue from a client, you take $1,000.

Money is important, yes. But you also want to enjoy what you do. There are two very different subsets of insurance, and you’ll want to put thought into which is better suited for you.

4. Insuring People vs. Things

The two major subsets of insurance are life/health and property/casualty.

Life/health deals with insurance like (you guessed it) life and health. It also includes things like disability and long term care. This stuff is people’s livelihoods. It’s insuring bodies and it’s as personal as it gets.

With property/casualty, you’re insuring physical objects instead of people. Home and auto insurance are personal to an extent, but they’re still property and less personal than life/health.

Once you’ve thought about whether you’d prefer to insure people or things, you’ll want to decide which customer segments you’d prefer to sell to.

5. Selling to Individuals vs. Businesses

For both subsets, you should also consider whether you’d prefer to sell to individuals or to businesses.

For example, someone selling general liability insurance to fortune 500 companies has a completely different job than someone selling health plans to individuals.

When it comes to the question of what does an insurance broker do, this is a perfect example of how much it can actually vary.

In my own business, I have found that selling insurance such as self-funded health plans to companies is something I really enjoy. But maybe you’d prefer to sell homeowners insurance to individuals.

That’s up to you to figure out.

It’s Okay If You Don’t Have All The Answers

If I can recommend one thing above all else for when you’re starting out, it’s to make sure you have the ability to do joint-work with more experienced reps. Someone to work alongside and learn the step by step process of your job.

And of course, to keep a long-term perspective when making career decisions.

Over time you will find what you enjoy doing, and I hope this post will have provided you some valuable guidance in starting out.

– Guest Post by Gus Altuzarra

Gus is the CEO of Aston Sharp Insurance Services. In 2012, Gus founded Aston Sharp to start offering a larger scope of insurance products to his clients. With extensive history in life, disability, and long-term care planning, Gus acts as a full service insurance advisor. Gus initially started working with group employers offering assistance with the new changes mandated by the ACA (Affordable Care Act). The in-flow of new technology in recent years has created an opportunity to revolutionize an outdated industry. Gus now works to consolidate Employee Benefits, HR, Payroll, Work Comp, and ACA compliance all under one roof – delivering an easy-to-use technology driven solution to his clients.

Gus,

Thanks for taking the time to write this article. As someone who is trying to get into the insurance industry I really appreciate the insight you provided.

Regards,

Matt

Great tips! Thanks for posting this useful info.